DISCOVERY HEALTH MEDICAL SCHEME PLAN RANGE SUMMARY

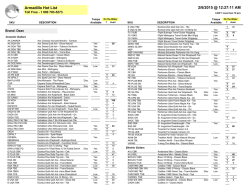

PLAN RANGE SUMMARY 2015 CONTRIBUTIONS Series EXECUTIVE COMPREHENSIVE PRIORITY SAVER CORE KEYCARE ** Plan Contributions to Medical Savings Account Contributions Total contributions Main member Adult Child* Main member Adult Child* Main member Adult Child* Executive 3 410 3 410 648 1 137 1 137 215 4 547 4 547 863 Classic Comprehensive 2 772 2 622 553 924 874 184 3 696 3 496 737 Classic Delta Comprehensive 2 497 2 362 497 832 787 165 3 329 3 149 662 Classic Comprehensive Zero MSA 2 772 2 622 553 No Medical Savings Account 2 772 2 622 553 Essential Comprehensive 2 640 2 496 532 465 440 93 3 105 2 936 625 Essential Delta Comprehensive 2 377 2 246 477 419 396 84 2 796 2 642 561 Classic Priority 1 859 1 463 744 619 487 248 2 478 1 950 992 Essential Priority 1 811 1 422 723 319 250 127 2 130 1 672 850 Classic Saver 1 629 1 283 652 543 427 217 2 172 1 710 869 Classic Delta Saver 1 301 1 026 523 433 342 174 1 734 1 368 697 Essential Saver 1 467 1 100 587 258 194 103 1 725 1 294 690 Essential Delta Saver 1 172 881 470 206 155 82 1 378 1 036 552 Coastal Saver 1 283 962 516 427 320 172 1 710 1 282 688 Classic Core 1 617 1 272 646 1 617 1 272 646 Classic Delta Core 1 294 1 018 517 1 294 1 018 517 Essential Core 1 389 1 040 557 1 389 1 040 557 Essential Delta Core 1 110 833 445 1 110 833 445 Coastal Core 1 195 896 477 1 195 896 477 KeyCare Plus (10 001+) 1 592 1 592 426 1 592 1 592 426 KeyCare Plus (7 051 – 10 000) 1 069 1 069 300 1 069 1069 300 KeyCare Plus (361 – 7 050) 764 764 276 764 764 276 KeyCare Plus (0 – 360) 330 330 330 330 330 330 KeyCare Access (10 001+) 1 556 1 556 420 1 556 1 556 420 KeyCare Access (7 051 – 10 000) 1 036 1 036 292 1 036 1 036 292 KeyCare Access (4 401 – 7 050) 718 718 258 718 718 258 KeyCare Access (0 – 4 400) 538 538 235 538 538 235 KeyCare Core (10 001+) No Medical Savings Account No Medical Savings Account 1 176 1 176 265 1 176 1 176 265 KeyCare Core (7 051 – 10 000) 762 762 187 762 762 187 KeyCare Core (0 – 7 050) 611 611 158 611 611 158 *W e count a maximum of three children when we work out the monthly contribution, Annual Medical Savings Account, Annual Threshold and Above Threshold Benefit Limit ** Income verification will be conducted for the lower income bands. Income is defined as: earnings, commission and rewards from employment; interest from investments; income from leasing of assets/property; distributions received from a trust, pension and/or provident fund; and financial assistance from any social assistance programme. Annual Thresholds Executive Plan and Comprehensive Series Vitality and KeyFIT contributions Member Adult dependant Child dependant * Executive Plan 13 640 13 640 2 550 Comprehensive Series 12 590 12 590 2 380 Member Adult dependant Child dependant * Annual Threshold 10 980 8 250 3 590 Above Threshold Benefit limit 9 340 6 650 3 210 Priority Series Vitality KeyFIT Vitality and KeyFIT Member 185 40 199 Member +1 219 49 239 Member +2 249 60 275 Vitality is not a part of the Discovery Health Medical Scheme. Vitality is a separate product sold and administered by Discovery Vitality (Pty) Ltd. Registration number 1999/007736/07, an authorised financial services provider. * We count a maximum of three children when we work out the Annual Threshold and Above Threshold Benefit limit. If members join the medical scheme after January, they won’t get the full amount because it is calculated by counting the remaining months in the year. GM_28813DHM_02/10/2014_V3 DISCOVERY HEALTH MEDICAL SCHEME PLAN RANGE SUMMARY EXECUTIVE PLAN COMPREHENSIVE SERIES • U nlimited cover in any private hospital, including private ward cover • Guaranteed full cover in hospital for specialists on a payment arrangement, and up to 300% of the Discovery Health Rate for other specialists • Full cover for chronic medicine for all Chronic Disease List conditions plus some additional chronic conditions; plus access to an exclusive list of brand medicines • The highest savings account and unlimited Above Threshold Benefit for your day-to-day healthcare needs • Additional cover when your Medical Savings Account runs out for GP consultation fees, preferred medicine, blood tests, maternity costs and some durable external medical items • Access to specialised, advanced medical care in SA and abroad • Cover for medical emergencies when travelling • Unlimited private hospital cover • Guaranteed full cover in hospital for specialists on a payment arrangement, and up to 200% of the Discovery Health Rate on Classic Plans and 100% on Essential Plans for other healthcare professionals • Full cover for chronic medicine for all Chronic Disease List conditions plus some additional chronic conditions • A high savings account as well as unlimited Above Threshold Benefit for your day-to-day healthcare needs • Additional cover when your Medical Savings Account runs out for GP consultation fees, preferred medicine, blood tests, maternity costs and some durable external medical items • Access to specialised, advanced medical care in SA and abroad • Cover for medical emergencies when travelling PRIORITY SERIES CLASSIC | ESSENTIAL | DELTA CLASSIC | ESSENTIAL • Unlimited cover in any private hospital • Guaranteed full cover in hospital for specialists on a payment arrangement, and up to 200% of the Discovery Health Rate on the Classic Plan and 100% on the Essential Plan for other healthcare professionals • Full cover for chronic medicine for all Chronic Disease List conditions • A savings account and limited Above Threshold Benefit for your day-to-day healthcare needs • Additional cover when your Medical Savings Account runs out for GP consultation fees, blood tests, maternity costs and some durable external medical items • Cover for medical emergencies when travelling PRODUCT PLATFORM THE GUARANTEE OF FULL COVER THE DISCOVERY HEALTH MEDICAL SCHEME OFFERS A RANGE OF OPTIONS TO CATER FOR EVERY NEED – FROM THE EXECUTIVE PLAN TO THE KEYCARE SERIES. EACH PLAN’S COVER RANGES FROM HOSPITALISATION TO CHRONIC MEDICINE, WITH MANY PLANS OFFERING DAY-TO-DAY COVER AS WELL. OUR EXTENSIVE NETWORKS OF HEALTHCARE PROVIDERS, COMBINED WITH OUR UNIQUE SELF-SERVICE TOOLS MEAN MEMBERS CAN ALWAYS AVOID CO-PAYMENTS. THESE TIPS WILL GUIDE MEMBERS TO FULL COVER. There is no overall limit for hospital cover on any Discovery Health Medical Scheme plan. Members can go to any private hospital on most plans. The Delta, Coastal and KeyCare Plans offer hospital cover in a defined network of hospitals. If members use a specialist who we have a payment arrangement with, we cover them in full for their approved procedure in hospital. CHRONIC ILLNESS COVER SCREENING AND PREVENTION The Screening and Prevention Benefit covers blood glucose, blood pressure, cholesterol and body mass index measurements at a Discovery Wellness Network provider. The benefit also pays for a mammogram, Pap smear, PSA (prostate screening test) and HIV screening tests. If members are 65 years or older or are registered for certain chronic conditions, we also cover a seasonal flu vaccine. We pay members’ day-to-day medical expenses from the Medical Savings Account on Executive, Comprehensive, Priority and Saver Plans. Any unused funds are carried over to the next year – unlike traditional plans where unused cover is lost. THE INSURED NETWORK BENEFIT EXTENDS MEMBERS’ DAY-TO-DAY COVER FOR ESSENTIAL HEALTHCARE SERVICES 1 All Discovery Health Medical Scheme plans offer a comprehensive list of medicine which we cover in full. The Executive Plan offers additional cover for an exclusive list of brand medicines. Under the Insured Network Benefit, we cover preferred medicine once members have spent the annual funds in their Medical Savings Account. Members can use Discovery MedXpress or express collections or ask a pharmacist to find the best alternative medicine to avoid a co-payment. The Executive, Comprehensive and Priority Plans include an Above Threshold Benefit that gives further day-to-day cover once members’ claims add up to a set amount (their Annual Threshold). On the Executive and Comprehensive Plans, the Above Threshold Benefit is unlimited. On the Priority Plans, the Above Threshold Benefit has an overall limit. Discovery Vitality offers the world’s leading science-based programme with a personalised approach to wellness USE OUR EXTENSIVE HOSPITAL NETWORKS Members are covered in full when they use a network hospital on plans that offer a defined network of hospitals. Members can use our online MaPS tool to find a hospital in our network. Hospital We extend members’ day-to-day cover through the Insured Network Benefit. When members have spent their annual Medical Savings Account allocation and before claims add up to the Annual Threshold, we cover services such as GP consultation fees, blood tests, day-to-day cost-effective medicine, maternity costs and durable external medical items from a provider in our network. Cover depends on the health plan members choose. THE ABOVE THRESHOLD BENEFIT FURTHER EXTENDS YOUR DAY-TO-DAY COVER 2 USE OUR PREFERRED MEDICINE 3 Day-to-day All Discovery Health Medical Scheme plans cover approved medicine for the Prescribed Minimum Benefit conditions. We pay approved chronic medicines that are on the Scheme’s medicine list in full, or up to a set monthly rand amount for medicines not on the medicine list. The Executive and Comprehensive Plans offer cover for additional conditions. On the Executive Plan members also have exclusive access to a defined list of brand medicines which we cover in full. YOUR HOSPITAL MEDICAL COVERSAVINGS ACCOUNT onic cover Chr HOSPITAL COVER 4 Doctor USE A GP OR SPECIALIST WHO WE HAVE A PAYMENT ARRANGEMENT WITH USE A NETWORK PROVIDER TO ACCESS THE INSURED NETWORK BENEFIT Our plans with a Medical Savings Account empowers members to make informed decisions on how to spend their day-to-day healthcare expenses. Once members have spent their annual Medical Savings Account allocation and before their claims add up to the Annual Threshold, we extend their day-today cover through the Insured Network Benefit. Members have cover for unlimited GP consultation fees, blood tests, preferred day-to-day medicine, maternity costs and certain durable external medical items. Cover for these healthcare services depends on the health plan you choose. Use our MaPS tool to find a network provider. We offer the broadest range of GP and specialist payment arrangements, which provide full cover both in and out of hospital. Over 90% of our member interactions are with a GP or specialist in our payment arrangements. Members can use our MaPS tool to find a healthcare professional who we have an arrangement with. Vitality helps you get healthier by giving you the knowledge, tools and motivation to improve your health – it’s been clinically proven that Vitality members are healthier, live longer and have lower healthcare costs. Vitality is not part of the Discovery Health Medical Scheme. Vitality is a separate product sold and administered by Discovery Vitality (Pty) Ltd. Registration number 1999/007736/07, an authorised financial services provider. SAVER SERIES CLASSIC | ESSENTIAL | DELTA | COASTAL • Unlimited private hospital cover • Guaranteed full cover in hospital for specialists on a payment arrangement, and up to 200% of the Discovery Health Rate on Classic Plans and 100% on Essential and Coastal Plans for other healthcare professionals • Full cover for chronic medicine for Chronic Disease List conditions • A savings account for your day-to-day healthcare needs • Additional cover when your Medical Savings Account runs out for GP consultation fees and maternity costs • Cover for medical emergencies when travelling CORE SERIES CLASSIC | ESSENTIAL | DELTA | COASTAL • Unlimited private hospital cover • Guaranteed full cover in hospital for specialists on a payment arrangement, and up to 200% of the Discovery Health Rate on Classic Plans and 100% on Essential and Coastal Plans for other healthcare professionals • Full cover for chronic medicine for Chronic Disease List conditions when you use MedXpress • Cover for medical emergencies when travelling KEYCARE SERIES PLUS | ACCESS | CORE • Unlimited hospital cover in the KeyCare network of hospitals • Guaranteed full cover in hospital for specialists in the KeyCare network, and up to 100% of the Discovery Health Rate for other healthcare professionals • Essential cover for chronic medicine on our medicine list for Chronic Disease List conditions • Unlimited cover for medically appropriate GP consultations, blood tests, x-rays or medicine in our KeyCare network on the KeyCare Plus and KeyCare Access Plans This brochure is intended for intermediary use. It is only a summary of the key benefits and features of the Discovery Health Medical Scheme plans, awaiting formal approval from the Council for Medical Schemes. Full details can be found in the Discovery Health Medical Scheme Rules on www.discovery.co.za. It also summarises other Discovery products and value-added services. For compliance questions, email [email protected]. Discovery Health Medical Scheme, registration number 1125, is administered by Discovery Health (Pty) Ltd, registration number 1997/013480/07, an authorised financial services provider. Vitality is not part of the Discovery Health Medical Scheme. Vitality is a separate product sold and administered by Discovery Vitality (Pty) Ltd, registration number 1999/007736/07, an authorised financial services provider.

© Copyright 2026