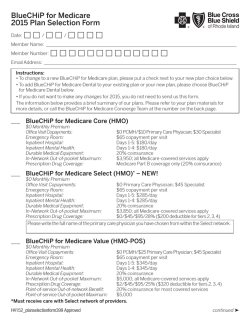

2015 Health Plans - Independence Blue Cross