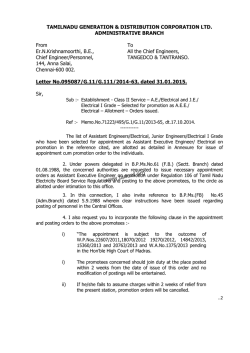

Corporate Plan Summary 2011-2015