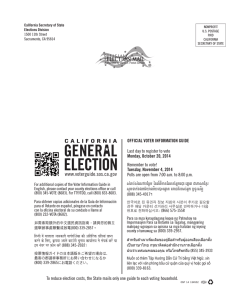

Sample Ballot - Santa Cruz County Election Department