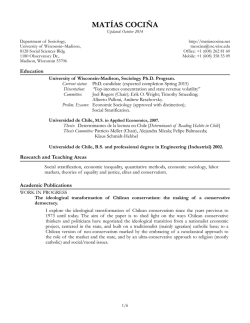

View - Repositorio UC