Kaleidoscopio - MONEX Grupo Financiero

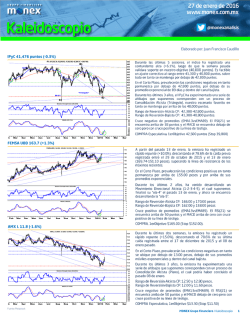

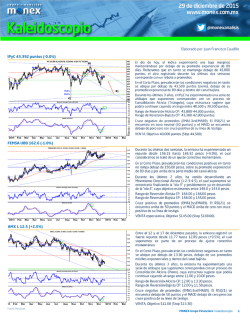

03 de febrero de 2016 www.monex.com.mx Kaleidoscopio @monexanalisis Elaborado por: Juan Francisco Caudillo IPyC 43,258 puntos (+0.4%) IPC (43,092.49, 43,306.38, 42,916.01, 43,257.54, +165.051) 465 460 455 450 445 440 435 430 425 420 415 410 405 400 395 390 D) 88.6% "Triángulo" 88.6% E) C) Relative Strength Index (56.7530) x100 C) "Plano" 65 60 55 50 45 40 35 30 MACD (139.795) 50 40 30 20 10 -10 -20 -30 -40 -50 -60 -70 x10 Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2016 Feb Mar Apr FEMSA UBD 169.5 (-1.6%) FEMSAUBD (172.240, 172.920, 168.800, 169.480, -2.74001) 180 175 170 165 160 155 150 145 140 135 130 125 Relative Strength Index (62.8130) 70 65 60 55 50 45 40 5 MACD (2.68268) 4 3 2 1 0 -1 -2 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2016 Feb Mar Apr AMX L 12.9 (+1.6%) AMXL (12.7300, 12.9800, 12.6300, 12.8900, +0.20000) 16.0 15.5 15.0 14.5 14.0 13.5 13.0 12.5 12.0 11.5 11.0 10.5 Relative Strength Index (58.5297) 65 60 55 50 45 40 35 30 MACD (0.12780) Feb Mar Apr Fuente: Metastock May Jun Jul Aug Sep Oct 0.3 0.2 0.2 0.1 0.1 0.0 0.0 -0.0 -0.1 -0.1 -0.2 -0.2 -0.3 -0.3 Nov Dec 2016 Feb Mar Apr MONEX Grupo Financiero / Kaleidoscopio 1 WALMEX * 45.8 pesos (+0.6%) WALMEX* (45.8400, 46.0900, 44.3700, 45.8000, +0.29000) 49 48 47 46 45 44 43 42 41 40 39 38 37 36 35 34 33 32 31 30 80 75 70 65 60 55 50 45 40 35 Relative Strength Index (58.6435) MACD (0.49562) 1.5 1.0 0.5 0.0 -0.5 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2016 Feb Mar Apr GFNORTE O 91.2 pesos (+1.2%) GFNORTEO (90.1100, 91.3900, 89.6700, 91.1600, +1.11000) 161.8% 105 100 127.2% 95 100.0% 90 85 80 75 0.0% Relative Strength Index (53.1110) 70 65 60 55 50 45 40 35 30 MACD (-0.18755) Mar Apr May Jun Jul Aug Sep Oct 3.0 2.5 2.0 1.5 1.0 0.5 0.0 -0.5 -1.0 -1.5 -2.0 Nov Dec 2016 Feb Mar Apr GMEXICO B 34.1 pesos (+1.7%) GMEXICOB (33.9700, 34.8900, 33.1000, 34.0900, +0.56000) 51 50 49 48 47 46 45 44 43 42 41 40 39 38 37 36 35 34 33 32 Relative Strength Index (42.6091) 70 65 60 55 50 45 40 35 30 25 MACD (-0.48180) 1.0 0.5 0.0 -0.5 -1.0 Mar Apr Fuente: Metastock May Jun Jul Aug Sep Oct Nov Dec 2016 Feb Mar Apr MONEX Grupo Financiero /Kaleidoscopio 2 Kaleidoscopio Internacional BOVESPA 39,589 puntos (+2.6%) 600 IBV (38,596.53, 39,725.69, 38,596.53, 39,588.82, +992.648) B) 550 500 A) 450 400 8% C)? x100 Relative Strength Index (42.3177) 65 60 55 50 45 40 35 30 25 MACD (-1,146.59) 10 5 0 -5 -10 -15 x100 2015 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2016 Feb Mar Apr EDC* 165.6 pesos (+5.8%) B) EDC* (157.500, 166.600, 153.400, 165.640, +9.14999) 500 450 400 350 300 250 200 150 C) Relative Strength Index (45.3349) 70 65 60 55 50 45 40 35 30 25 MACD (-8.12553) Feb Mar Apr May Jun Jul Aug Sep 25 20 15 10 5 0 -5 -10 -15 -20 -25 -30 Oct Nov Dec 2016 Feb Mar Apr EDZ* 989.8 pesos (-9.1%) 140 135 130 125 120 115 110 105 100 95 90 85 80 75 70 65 60 55 50 45 40 35 EDZ* (1,090.00, 1,110.00, 980.110, 989.840, -99.0101) x10 85 80 75 70 65 60 55 50 45 40 35 Relative Strength Index (51.0302) MACD (46.1807) 100 50 0 -50 Feb Mar Apr Fuente: Metastock May Jun Jul Aug Sep Oct Nov Dec 2016 Feb Mar Apr MONEX Grupo Financiero / Kaleidoscopio 3 Indicadores Técnicos Ultimo Precio Soporte Resistencia 43,258 108.5 32.0 63.0 12.9 240.9 51.4 8.4 346.9 169.5 149.3 70.2 31.6 29.5 91.2 86.3 34.1 268.0 4.4 53.2 75.4 42.3 126.2 12.2 16.2 43.3 209.1 36.5 23.2 18.4 85.6 184.5 211.9 27.6 38.2 10.9 96.1 45.8 41,300 98.0 30.0 58.0 11.0 220.0 45.0 7.0 320.0 150.0 140.0 62.0 28.5 27.0 82.0 80.0 33.0 240.0 3.0 52.0 68.0 38.0 115.0 12.0 15.0 39.0 190.0 35.0 22.0 16.0 75.0 155.0 185.0 26.0 36.0 10.4 90.0 42.5 43,800 115.0 34.0 65.0 13.3 250.0 52.0 8.5 380.0 175.0 155.0 75.0 33.0 30.0 97.0 90.0 37.5 280.0 6.0 60.0 78.0 44.0 130.0 14.0 17.5 44.0 220.0 40.0 25.0 19.0 88.0 205.0 220.0 30.0 40.0 12.4 105.0 47.0 -4.5% -9.7% -6.3% -8.0% -14.7% -8.7% -12.5% -16.7% -7.8% -11.5% -6.2% -11.7% -9.8% -8.4% -10.0% -7.2% -3.2% -10.5% -31.7% -2.2% -9.9% -10.1% -8.8% -1.8% -7.6% -9.8% -9.1% -4.2% -5.1% -13.0% -12.4% -16.0% -12.7% -5.9% -5.7% -4.9% -6.3% -7.2% Dow Jones (EUA) S&P (EUA) Nasdaq Comp (EUA) UKX (RU) DAX (Alemania) CAC (Francia) IBEX (España) FTSEMIB (Italia) NKY (Japón) HSI (China) IBOV (Brasil) IPSA (Chile) Principales Divisas 16,337 1,913 4,172 5,837 9,435 4,227 8,315 17,412 17,191 18,992 39,589 3,590 15,800 1,830 4,000 5,500 9,000 4,000 8,300 17,200 15,800 18,000 37,500 3,300 17,000 2,000 4,500 6,500 10,700 4,700 9,600 21,500 18,800 21,800 44,000 3,900 MXN (Peso-Dólar) EUR (Euro-Dólar) GBP (Libra-Dólar) JPY (Yen-Dólar) BRL (Real B.-Dólar) ETFs (pesos) 18.18 1.11 1.46 117.88 3.90 17.80 1.05 1.40 115.00 3.85 NAFTRAC (IPyC) 43.3 ANGEL (200% IPyC) 23.5 DIABLO (-100% IPyC) 14.0 EDC* (300% Emergentes) 165.6 EDZ* (-300% Emergentes) 989.8 FAS* (300% Financ. EUA) 370.2 FAZ* (-300 Financ. EUA) 997.0 GLD* (Oro) 1,991.0 SLV* (Plata) 254.2 DIA* (Dow Jones) 2,972.0 SPY* (S&P) 3,485.8 QQQ* (Nasdaq) 1,850.1 EWZ* (Brasil) 358.0 EWJ* (Japón) 203.1 EWG* (Alemania) 439.2 EWU* (Inglaterra) 274.6 EWP* (España) 462.9 Fuente: Monex con base en Bloomberg ERUS* (Rusia) 188.8 38.0 20.0 14.0 140.0 800.0 360.0 800.0 1,700.0 230.0 2,500.0 3,000.0 1,500.0 320.0 175.0 380.0 245.0 450.0 168.0 Emisoras (IPyC) IPyC AC* ALFAA ALSEA* AMXL ASURB BIMBOA CEMEXCPO ELEKTRA* FEMSAUBD GAPB GCARSOA1 GENTERA* GFINBURO GFNORTEO GFREGIO GMEXICOB GRUMAB ICA* ICHB IENOVA* KIMBERA KOFL LABB LACOMUBC LALAB LIVERPOLC MEXCHEM* NEMAKA OHLMEX* OMAB PE&OLES PINFRA* SANMEXB SIMECB SITESL TLEVICPO WALMEX* Principales Indices Var vs Var % vs Soporte Resist. Rend. / Riesgo RSI (9) PMS % Precio 10 Días vs PM PMS 30 % Precio PMS 100 % Precio PMS 200 % Precio Días vs PM Días vs PM Días vs PM 1.3% 6.0% 6.2% 3.1% 3.2% 3.8% 1.1% 1.2% 9.5% 3.3% 3.8% 6.8% 4.5% 1.7% 6.4% 4.3% 10.0% 4.5% 36.7% 12.9% 3.4% 4.0% 3.1% 14.6% 7.8% 1.7% 5.2% 9.5% 7.8% 3.3% 2.8% 11.1% 3.8% 8.6% 4.7% 13.3% 9.3% 2.6% 0.3 0.6 1.0 0.4 0.2 0.4 0.1 0.1 1.2 0.3 0.6 0.6 0.5 0.2 0.6 0.6 3.1 0.4 1.2 5.9 0.3 0.4 0.3 8.1 1.0 0.2 0.6 2.3 1.5 0.3 0.2 0.7 0.3 1.5 0.8 2.7 1.5 0.4 66 68 51 64 69 64 87 51 49 86 48 52 56 59 55 61 38 86 65 41 67 63 59 41 60 74 64 46 47 60 63 72 69 51 44 42 57 62 41,908 105.8 31.6 61.9 12.0 236.7 48.3 7.8 338.5 164.6 147.9 67.7 30.7 28.3 87.3 83.7 34.5 257.6 3.6 53.8 71.0 41.4 121.8 12.7 15.9 41.2 204.1 36.3 22.9 16.7 81.8 161.9 200.9 27.3 38.5 11.0 96.0 44.8 -3.3% -4.3% -4.1% -5.8% -4.6% -5.4% -0.2% -1.2% -8.1% -5.2% -5.3% -8.1% 4.1% 4.6% 7.9% 11.4% 13.4% 11.2% 15.5% 23.5% 9.4% 14.8% 11.1% 8.6% 1.2 1.1 1.9 2.0 2.9 2.1 88.7 19.3 1.2 2.8 2.1 1.1 45 45 43 48 40 43 40 33 46 39 42 59 16,088 1,897 4,204 5,912 9,695 4,313 8,617 18,539 17,133 19,179 38,553 3,572 1.5% 0.8% -0.8% -1.3% -2.8% -2.0% -3.6% -6.5% 0.3% -1.0% 2.6% 0.5% 16,654 1,958 4,363 5,998 10,040 4,419 8,986 19,828 17,760 20,214 40,774 3,581 -1.9% -2.4% -4.6% -2.8% -6.4% -4.6% -8.1% -13.9% -3.3% -6.4% -3.0% 0.3% 17,063 2,008 4,462 6,167 10,328 4,633 9,741 21,320 18,474 21,608 44,895 3,702 -4.4% -5.0% -7.0% -5.7% -9.5% -9.6% -17.2% -22.4% -7.5% -13.8% -13.4% -3.1% 17,364 2,044 4,462 6,429 10,762 4,783 10,365 22,150 19,285 23,628 48,630 3,811 -6.3% -6.9% -7.0% -10.1% -14.1% -13.1% -24.7% -27.2% -12.2% -24.4% -22.8% -6.2% 18.80 1.15 1.52 123.50 4.05 -2.1% -5.5% -4.1% -2.4% -1.2% 3.4% 3.5% 4.1% 4.8% 4.0% 1.6 0.7 1.0 2.0 3.3 49 71 64 42 33 18.40 1.09 1.43 119.07 4.04 -1.2% 1.9% 1.8% -1.0% -3.7% 17.92 1.09 1.45 118.85 4.01 1.4% 1.9% 0.7% -0.8% -3.0% 17.10 1.10 1.50 120.59 3.91 6.0% 1.3% -2.7% -2.3% -0.3% 16.51 1.11 1.53 121.49 3.58 9.2% 0.5% -4.5% -3.1% 8.2% 44.0 25.0 16.0 200.0 1,250.0 460.0 1,100.0 2,200.0 280.0 3,050.0 3,600.0 1,900.0 400.0 220.0 500.0 300.0 580.0 210.0 -12.2% -15.0% -0.1% -15.5% -19.2% -2.8% -19.8% -14.6% -9.5% -15.9% -13.9% -18.9% -10.6% -13.8% -13.5% -10.8% -2.8% -11.0% 1.7% 6.2% 14.2% 20.7% 26.3% 24.3% 10.3% 10.5% 10.1% 2.6% 3.3% 2.7% 11.7% 8.3% 13.8% 9.2% 25.3% 11.2% 0.1 0.4 199.0 1.3 1.4 8.8 0.5 0.7 1.1 0.2 0.2 0.1 1.1 0.6 1.0 0.9 9.1 1.0 67 64 33 46 51 39 57 65 51 56 60 54 57 58 43 57 42 46 41.9 22.3 14.5 154.3 1,124.0 377.7 1,034.8 1,953.1 249.1 2,952.8 3,488.4 1,882.9 336.1 206.0 442.5 272.8 472.1 186.5 3.1% 5.2% -3.2% 6.8% -13.6% -2.0% -3.8% 1.9% 2.0% 0.6% -0.1% -1.8% 6.1% -1.4% -0.8% 0.7% -2.0% 1.2% 42.0 22.6 14.4 173.0 993.4 438.9 870.7 1,856.3 238.4 2,971.0 3,489.6 1,893.5 348.2 207.3 445.6 273.9 487.1 204.4 3.1% 42,024 2.9% 43,229 0.1% 43,912 -1.5% 2.5% 103.8 4.3% 101.1 6.8% 97.7 9.9% 1.3% 32.5 -1.3% 33.8 -5.5% 32.9 -2.6% 1.8% 59.8 5.1% 56.4 10.5% 52.7 16.5% 6.6% 11.9 7.4% 12.9 -0.2% 13.9 -7.6% 1.7% 237.2 1.5% 251.6 -4.5% 241.9 -0.4% 6.1% 47.1 8.5% 45.8 10.9% 43.8 14.8% 7.7% 8.4 0.1% 10.4 -23.3% 12.3 -46.0% 2.4% 349.9 -0.8% 330.8 4.6% 343.6 1.0% 2.9% 160.5 5.3% 158.8 6.3% 151.0 10.9% 0.9% 149.7 -0.3% 150.5 -0.8% 134.1 10.2% 3.5% 69.4 1.1% 73.2 -4.3% 70.7 -0.6% 2.8% 31.3 0.9% 30.4 3.7% 28.8 8.9% 4.0% 29.5 0.0% 32.3 -9.4% 34.2 -15.9% 4.2% 90.0 1.3% 87.9 3.6% 86.7 4.9% 3.0% 85.9 0.4% 88.9 -3.1% 89.0 -3.2% -1.3% 35.5 -4.3% 38.6 -13.1% 41.9 -23.0% 3.9% 248.1 7.4% 245.4 8.4% 224.8 16.1% 17.4% 3.4 21.5% 5.8 -32.5% 8.7 -97.1% -1.2% 54.1 -1.8% 57.4 -7.9% 59.2 -11.3% 5.9% 71.4 5.4% 73.5 2.5% 77.3 -2.5% 2.1% 40.1 5.1% 39.5 6.7% 37.0 12.4% 3.4% 121.7 3.5% 122.3 3.0% 123.1 2.4% -3.6% 13.1 -7.0% 13.0 -6.6% 14.5 -18.5% 1.9% #N/A N/A #¡VALOR! #N/A N/A #¡VALOR! #N/A N/A #¡VALOR! 4.7% 40.6 6.1% 41.0 5.3% 37.7 12.9% 2.4% 206.1 1.4% 218.5 -4.5% 200.7 4.0% 0.7% 37.5 -2.6% 40.8 -11.6% 42.9 -17.5% 1.1% 23.0 0.8% 22.5 2.9% #N/A N/A #¡VALOR! 9.4% 17.5 5.2% 20.0 -8.6% 21.8 -18.3% 4.5% 81.2 5.1% 83.6 2.4% 81.9 4.4% 12.3% 168.2 8.8% 205.4 -11.3% 230.8 -25.1% 5.2% 200.2 5.6% 198.8 6.2% 187.4 11.6% 1.4% 28.4 -2.8% 28.5 -3.2% 28.8 -4.2% -0.9% 37.9 0.8% 40.9 -7.0% 43.4 -13.5% -0.5% #N/A N/A #¡VALOR! #N/A N/A #¡VALOR! #N/A N/A #¡VALOR! 0.1% 95.1 1.0% 94.2 2.0% 103.0 -7.3% 2.1% 43.8 4.4% 43.1 5.9% 40.6 11.4% 2.8% 43.3 0.0% 44.0 -1.6% 3.8% 24.4 -3.7% 25.9 -10.0% -3.1% 14.5 -3.3% 14.5 -3.5% -4.5% 211.0 -27.4% 277.2 -67.4% -0.4% 806.7 18.5% 684.9 30.8% -18.6% 468.3 -26.5% 489.5 -32.2% 12.7% 784.1 21.4% 749.3 24.8% 6.8% 1,812.9 8.9% 1,775.7 10.8% 6.2% 237.9 6.4% 237.5 6.6% 0.0% 2,883.4 3.0% 2,833.0 4.7% -0.1% 3,419.8 1.9% 3,356.1 3.7% -2.3% 1,851.4 -0.1% 1,786.5 3.4% 2.7% 378.0 -5.6% 440.1 -22.9% -2.1% 203.9 -0.4% 203.4 -0.2% -1.5% 440.7 -0.3% 447.4 -1.9% 0.3% 281.0 -2.3% 287.3 -4.6% -5.2% 516.0 -11.5% 526.4 -13.7% -8.3% Grupo 207.0 -9.6%/Kaleidoscopio #N/A N/A #¡VALOR! MONEX Financiero 4 Análisis Técnico MONEX Grupo Financiero /Kaleidoscopio 5 Directorio Dirección de Análisis y Estrategia Bursátil Carlos A. González Tabares Director de Análisis y Estrategia Bursátil T. 5231-4521 [email protected] Daniela Ruíz Zárate Analista Económico T. 5231-0200 Ext. 0019 [email protected] Fernando E. Bolaños S. Gerente de Análisis / Industrial, Petroquímico, Telcos T. 5230-0200 Ext. 0720 [email protected] J. Roberto Solano Pérez Analista Bursátil / Construcción, Vivienda y Fibras T. 5230-0200 Ext. 4451 [email protected] Verónica Uribe Boyzo Analista Bursátil / Alimentos y Bebidas T. 5230-0200 Ext. 4782 [email protected] Giselle N. Mojica Plascencia Analista Bursátil T. 5230-0200 Ext. 4287 [email protected] Laura Villanueva Ramírez Analista Bursátil T. 5230-0200 Ext. 4768 [email protected] Stephany Ramírez Rojas Analista Deuda Corporativa T. 5230-0200 Ext. 4262 [email protected] J. Francisco Caudillo Lira Analista Técnico Sr. T. 5231-0016 [email protected] Astianax Cuanalo Dorantes Analista Sr. de Sistemas de Información T. 5230-0200 Ext. 4790 [email protected] MONEX Grupo Financiero /Kaleidoscopio 6 Disclaimer MONEX Grupo Financiero /Kaleidoscopio 7

© Copyright 2026